Highlights:

- Acquisition immediately accretive to the Company

- Another major step forward, now fully supplying Train 1 at the Goldboro LNG facility

- Pieridae becomes a major player in the Alberta midstream and upstream industry

- Shell Canada Energy to take an equity stake in Pieridae

- Other key stakeholders to increase their ownership positions

CALGARY, ALBERTA – June 26, 2019 - Pieridae Energy Limited (“Pieridae” or the “Company”) (TSXV: PEA) is pleased to announce that it has signed a purchase and sale agreement (the “Purchase Agreement”) with Shell Canada Energy (“Shell”) to purchase all of Shell’s midstream and upstream assets in the southern Alberta Foothills (the “Assets”) for a purchase price of CAD$190 million, subject to normal adjustments (the “Acquisition”). The purchase price for the Acquisition will be satisfied via (i) the payment to Shell of CAD$175 million in cash (net of adjustments), to be raised by Pieridae through the issuance of term debt and equity, as further described below and (ii) the issuance of Pieridae common shares to Shell having an aggregate value of CAD$15 million (such value to be determined proximate to the time of closing of the Acquisition, in accordance with the terms of the Purchase Agreement). Closing of the Acquisition remains subject to satisfactory completion of due diligence by Pieridae on the Assets. Subject to such due diligence completion, the closing of the Acquisition is expected to occur in the third quarter of 2019, pending satisfaction of customary closing conditions and receipt of regulatory approvals.

“This Acquisition will be immediately accretive to the Company and also allows us to enhance the sustainability of our existing asset base,” said Pieridae’s Chief Executive Officer Alfred Sorensen.

“It also demonstrates solid progress for our flagship Goldboro LNG project. We said we would acquire additional gas supplies for the LNG facility and we have done that. Not only does this deal help us secure the remaining conventional natural gas supply needed for the first train of the Goldboro LNG project, it makes Pieridae a major player in the Alberta midstream and upstream industry.

“But more than that, it creates a solid, ongoing foundation for the Company as we continue to build toward becoming the first Canadian company to market LNG off the east coast to global consumers,” concluded Sorensen.

The conventional natural gas assets Pieridae controls are expected to allow the Company to access up to US$1.5 billion in credit support from the German government under the UFK program to develop these upstream assets as part of the Goldboro LNG Project.

Description of Assets being Acquired

The Assets currently produce approximately 28,623 barrels of oil equivalent per day (“BOE/d”) (based on Q1 2019 average) consisting of approximately 118.9 million cubic feet per day (“MMcf/d”) of natural gas, 5,646 barrels per day (“bbl/d”) of natural gas liquids (“NGLs”) and 3,161 bbl/d of condensate and light oil. Pieridae will also acquire three deep cut, sour gas processing plants (Jumping Pound, Caroline and Waterton) in the Acquisition, with a combined capacity of approximately 750 MMcf/d (currently operating with 420 MMcf/d of spare capacity), a 14% working interest in the Shantz sulphur forming plant, and approximately 1,700 kilometres of pipelines.

Net annual operating income (“NOI”)[1] of the Assets is approximately $60 million (based on Q1, 2019 rolling 12-months adjusted NOI). Pieridae anticipates continuing to grow this revenue through finding efficiencies in the field and by expanding third party revenue.

“Pieridae would also like to acknowledge the Treaty 7 Nations as long-term, vital partners with respect to the Assets,” said Sorensen. “In the spirit of reconciliation and cooperation, Pieridae remains committed to respectful engagement and collaboration with Indigenous Peoples.”

The Acquisition builds on the milestones already achieved by Pieridae, including:

- Acquiring substantial natural gas assets in the Alberta Foothills, allowing Pieridae to provide the gas supply needed for Goldboro’s first train[2];

- Receiving all major regulatory, environmental, import/export and construction permits for the Goldboro LNG Project[3];

- Signing a 20-year agreement with German utility giant Uniper for the full capacity of Goldboro’s first Train and half of the total project;

- Confirming the German Government’s support of the project, declaring it eligible in principle for up to US$4.5 billion in loan guarantees, including US$1.5 billion for upstream development (the details of such loan guarantees have been previously disclosed by Pieridae)[4];

- Continuing to negotiate arrangements to use existing pipelines to transport the natural gas from Western Canada to the Goldboro facility’s front door;

- Signing a benefits agreement with the Assembly of Nova Scotia Mi’kmaq Chiefs, allowing the Mi’kmaq to benefit economically from the development, construction and operation of Goldboro[5]; and

- Reaching a project labour agreement with major Nova Scotia trade unions to ensure fair employment opportunities in that province during Goldboro’s construction[6].

Pieridae continues to work with global engineering firm Kellogg Brown & Root Limited (KBR) to review an amended version of the previously prepared front-end engineering and design (FEED) study for the project, and to conduct an open-book estimate necessary to finalize a lump-sum, turnkey engineering, procurement and construction contract with KBR.

Acquisition Highlights and Rationale

The Assets to be acquired align well with Pieridae’s existing Central Alberta properties, providing further consolidation of the productive Alberta and British Columbia conventional foothills natural gas pools. It is expected that synergies will be realized in the northern part of the acquired Assets area, where consolidation of working interests in production and midstream assets complement Pieridae’s existing core areas. The Assets consist of long life, low decline production, in the range of 10%, with very high liquids and sulphur yields.

The acquired Assets are well suited to the technical skill set that currently exists within the workforce of Pieridae. Existing production and new drilling inventory will provide significant new gas supply along with an extensive, well maintained, underutilized and sophisticated gas midstream system. The associated liquids will provide accretive NOI and the associated gas will provide a large contribution to the 800 MMcf/d of conventional gas supply that is required for train 1 of the Goldboro LNG facility. The three large gas processing plants included in the Acquisition feed into the TC Energy Pipeline System and are located south of the normally congested James River transport corridor. This is anticipated to result in lower transportation tolls to AECO and fewer outages.

“Pieridae is excited to retain the well-trained staff that have been exceptionally diligent at maintaining the Assets for decades,” said Pieridae’s Chief Operating Officer Tim de Freitas. “This dedicated workforce is expected to continue to provide operational oversight of the acquired properties and will form a vital part of the long term Goldboro project. Our highly regarded foothills professionals will complement this workforce and together will form a highly effective team that will develop these structurally complex, conventional reservoirs.”

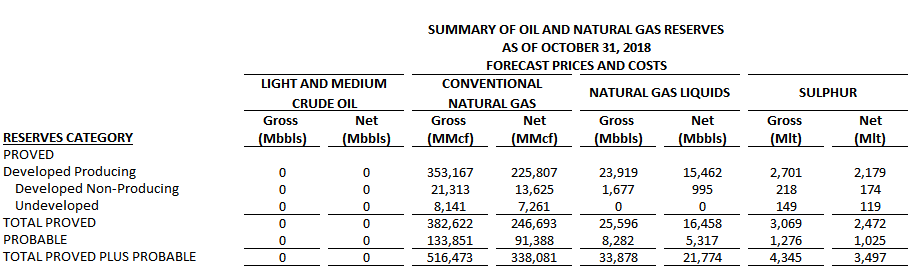

The Assets’ Proved Developed Producing (“PDP”) reserves on an MBOE basis make up 70% of total reserve bookings, while undeveloped reserves are only 6% of the total reserve base (based on independent third-party engineering reports, described further below).

Third party revenue received from production associated with the Assets is expected to be between $20 and $25 million a year, and Pieridae anticipates further growth in this part of the business due to the exceptional gas and liquids processing capabilities at the acquired plants. Shell will retain responsibility for known environmental remediation relating to the midstream assets.

Summary of Transaction

| Purchase Price (1) | $190 million |

| Trailing Production from Assets (2) | 28,623 BOE/d |

| NGL Production from Assets (2) | 5,646 (bbl/d) |

| Condensate Production from Assets (2) | 3,161(bb/d) |

| Trailing NOI from Assets (3) | $60 million |

| Oil, Condensate, and NGL Proportion of Production | 31% |

| Land | |

| Net developed and undeveloped acres (4) | 257,400 |

| Reserves being Acquired (5) | |

| PDP | 82.78 MMBOE |

| Proved Reserves | 89.38 MMBOE |

| Proved and Probable Reserves (6) | 119.96 MMBOE |

| Undeveloped Proved & Probable Reserves (7) | 7.1 MMBOE |

| Metrics | |

| $/BOE/d | $6,638 |

| $/PDP – BOE | $2.30 |

| $/2P – BOE | $1.58 |

| Multiple of trailing NOI (3) | 3.17x |

| Major midstream & associated assets | |

| Caroline Gas Plant | Deep cut, sulphur handling |

| Jumping Pound Gas Plant | Deep cut, sulphur handling |

| Waterton Gas Plant | Deep cut, sulphur handling |

| Landfill site, 14% ownership in the Shantz sulphur forming facility, water disposal capabilities, >1700 km of associated pipelines; numerous additional processing facilities |

Notes:

- Includes $15 million of shares to be issued to Shell at closing of the Acquisition.

- Average production Q1, 2019.

- Q1 2019 trailing 12-month adjusted NOI.

- Approximate number of net acres in Alberta.

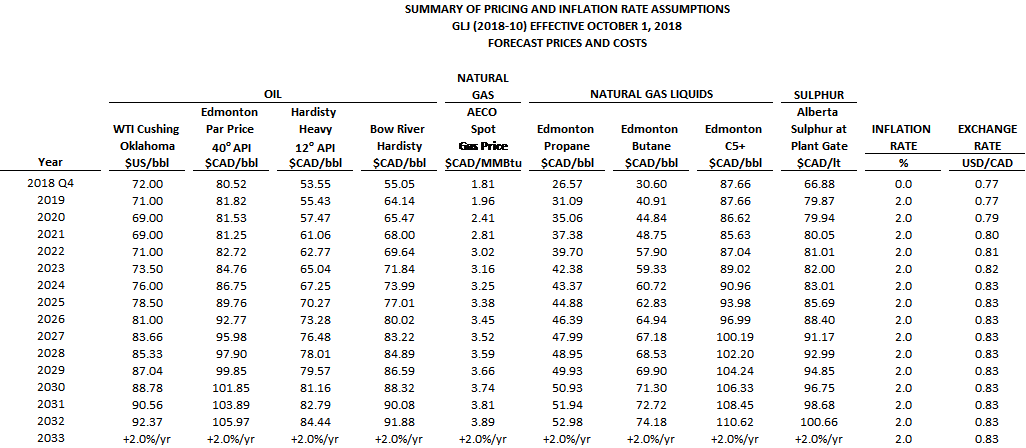

- Reserves are the sum of two reserve reports on the Shell Assets - Deloitte LLP prepared a report on certain Assets with an effective date of November 1, 2018, using the GLJ escalating price deck of October 2018 (the “Deloitte Report”) and GLJ Petroleum Consultants prepared a report on the balance of the Assets with an effective date of November 1, 2018, using the GLJ escalating price deck of October 2018 (the “GLJ Report”). Each of the Deloitte Report and the GLJ Report were prepared in accordance with National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities.

- Reserves exclude NOI of sulphur for the 5 years including 2019 through to 2023.

- Proved undeveloped capex is $31.3 million and proved plus probable undeveloped capex is $58.8 million.

Pro-Forma Impact to Pieridae (Consolidated Corporate Basis)

| Pre – Acquisition | Post - Acquisition | |

|---|---|---|

| Production | 16,000-18,000 BOE/d | 40,000 – 50,000 BOE/d |

| NOI | $0-10 million | $55 – 75 million (1) |

| Western Canada Land | ~650,000 net acres | ~900,000 net acres |

| PDP reserves | 60.1 MMBOE | 60.1 & 82.7 MMBOE (2) |

| Total proved reserves ("Proved") | 83.9 MMBOE | 83.9 & 89.3 MMBOE (2) |

| Total proved plus probable reserves ("2P") | 113.2 MMBOE | 113.2 & 120.0 MMBOE (2) |

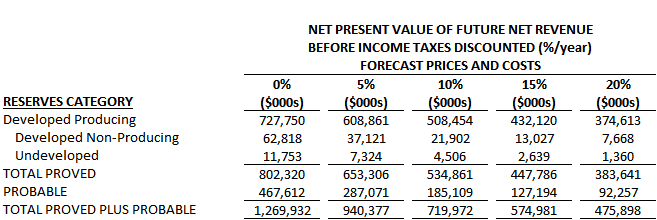

| PDP NPV of future net revenue (discounted at 10%) | $245 million (3) | $245 million & $508 million (2) |

| Proved NPV of future net revenue (discounted at 10%) | $303 million (3) | $303 million & $535 million (2) |

| 2P NPV of future net revenue (discounted at 10%) | $396 million (3) | $396 million & $720 million (2) |

Notes:

- Estimated forward NOI is based on average prices and operating expenses (“OPEX”) of $14.39/BOE for Q1 2019, with an assume decline of 10%/year. OPEX is assumed constant, though the corporation anticipates OPEX reductions in the first year of operations.

- These values cannot be added, because they have different effective dates and price assumptions. The corporate reserves of Pieridae, pre-Acquisition, were previously disclosed on April 24, 2019 and have a four-evaluator average price assumption as at year end 2018. The Shell Assets have been evaluated in the GLJ Report and the Deloitte Report and use the October 2018 GLJ price forecasts and have an effective date of November 1, 2018.

- Estimated values of future net revenue do not represent fair market value.

Pro forma production from the Assets is expected to be 40,000 to 50,000 BOE/d and decline at about 10%. The enriched mix of gas and associated gas by-products is expected to provide more cash flow stability as compared to a dry gas production asset base. Pieridae anticipates that NOI from the Assets will be largely sufficient to significantly progress the Goldboro project toward a final investment decision.

Below is a summary of the reserves attributable to the Assets and the future net revenue of such reserves, taken from the GLJ Report and the Deloitte Report:

The Acquisition from Shell is being completed on an arm’s length basis. It is expected that the common shares of Pieridae will remain halted until the TSX Venture Exchange has completed, to its satisfaction, its review of the Acquisition.

Equity Private Placement

In conjunction with the Acquisition, Pieridae is pleased to announce it has launched: (i) a non-brokered private placement of common shares of the Company for the placement of up to 3,488,372 common shares at a price of $0.86 per common share, for aggregate gross proceeds of up to $3 million (the “Common Share Offering”); (ii) a non-brokered private placement of a secured convertible debenture of the Company for aggregate gross proceeds of $10 million (the “Convertible Debenture Offering”); and (iii) a brokered private placement, led by Haywood Securities Inc. as sole agent, for the placement of up to 44,186,047 subscription receipts of the Company at a price of $0.86 per subscription receipt for gross proceeds of up to CAD$38 million (the “Subscription Receipt Offering”, and together with the Common Share Offering and the Convertible Debenture Offering, the “Offering”). Gross proceeds from the Offering are expected to be up to CAD$51 million. Key stakeholders Alfred Sorensen (CEO), Myron Tetreault (Chairman) and Charles Boulanger (Director) have subscribed for an aggregate of $2.2 million in the Common Share Offering.

On the closing date of the Acquisition, each subscription receipt issued under the Subscription Receipt Offering (the “Subscription Receipts”) will automatically be exchanged on a one-to-one basis for common shares of Pieridae without any further action on the part of the holder thereof and without payment of additional consideration. If the Acquisition is not completed, the full purchase price of the Subscription Receipts, plus any accrued interest thereon, will be returned to the subscribers under the Subscription Receipt Offering.

The proceeds from the sale of Subscription Receipts will be held by a trustee, as escrow agent, until the earlier of the closing date of the Acquisition or the Termination Date (as defined herein). If the closing of the Acquisition does not occur on or before October 31, 2019 (the “Outside Time” under the Purchase Agreement), or is terminated at any earlier time pursuant to the terms and conditions of the Purchase Agreement (in either case, the “Termination Date”), holders of Subscription Receipts will have the full purchase price of the Subscription Receipts, plus any accrued interest thereon, returned to them.

Alberta Investment Management Corporation (“AIMCo”) is the sole participant in the Convertible Debenture Offering. The common shares issuable thereunder will be issued to AIMCo immediately after the Acquisition has been completed at a conversion price of $0.86 per common share. If the Acquisition is not completed and the Convertible Debenture has not been converted into common shares, the principal and interest owing under the Convertible Debenture is due and payable to AIMCo on the earliest of (i) September 30, 2019 and (ii) the day which an acceleration notice is delivered or deemed to be delivered, as per the terms and conditions of Pieridae’s senior secured credit agreement with AIMCo dated December 20, 2018.

Pieridae will use the net proceeds of the Offering towards the purchase price payable for the Acquisition and for working capital purposes. The securities issued pursuant to the Offering are subject to a statutory four-month hold period from the date of closing of the Offering and applicable U.S. resale restrictions. The securities described herein have not been registered under the U.S. Securities Act of 1933 (the “Act”), as amended, and may not be offered or sold in the United States unless registered under the Act or unless an exemption from registration is available.

Haywood Securities Inc. is also acting as financial advisor to Pieridae on the Acquisition.

Term Debt Financing

In conjunction with the Acquisition, Pieridae is pleased to announce it has entered into a non-binding term sheet with a third-party lender for an issuance of senior secured term debt in the aggregate amount of USD $153 million (the “Term Debt Financing”).

The loan to be advanced pursuant to the Term Debt Financing is expected to bear interest at a rate of 13.3% from the date of issue, with interest expected to be payable quarterly, and is expected to have a maturity date of five years from the closing of the Acquisition.

Pieridae will use the net proceeds of the Term Debt Financing to partially fund the purchase price payable for the Acquisition and the repayment of its current outstanding debt to AIMCo and for working capital purposes.

The closing of the Term Debt Financing is subject to the satisfaction of certain conditions including, but not limited to: (i) approval of the lender’s investment committee; (ii) completion of satisfactory due diligence by the lender on the Assets including, but not limited to customary technical, reservoir, engineering / operations, market, environmental and counterparty due diligence; (iii) execution of satisfactory offtake contracts with Shell; and (iv) completion of a minimum equity raise under the Offering.

Adoption of Stock Option Plan

Pieridae also announces that its Board of Directors has adopted a fixed number 2019 Stock Option Plan, under which Pieridae may issue stock options exercisable for up to 8,412,199 common shares, representing 10% of Pieridae’s current issued and outstanding common shares (the “Options Maximum”). The total number of stock options of Pieridae that may be issued under both this 2019 Stock Option Plan and Pieridae’s previously approved 2017 Stock Option Plan cannot exceed the Options Maximum.

No stock options have yet been granted under the 2019 Stock Option Plan.

The 2019 Stock Option Plan has been approved by the TSX Venture Exchange, subject only to standard conditions.

About Pieridae

Founded in 2011, Pieridae, a majority Canadian owned corporation based in Calgary, is focused on the development of integrated energy-related activities, from the exploration and extraction of natural gas to the development, construction and operation of the Goldboro LNG facility and the production of LNG for sale to Europe and other markets. Pieridae is on the leading edge of the re-integration of the LNG value chain in North America. Pieridae’s common shares trade on the TSX Venture Exchange under the symbol PEA.

Reserves Data

Statements relating to “reserves” are deemed to be forward looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described exist in the quantities predicted or estimated and that the reserves can be profitably produced in the future. There are numerous uncertainties inherent in estimating quantities of crude oil, natural gas and NGL reserves and the future cash flows attributed to such reserves. The reserve and associated cash flow information set forth above are estimates only. In general, estimates of economically recoverable crude oil, natural gas and NGL reserves and the future net cash flows therefrom are based upon a number of variable factors and assumptions, such as historical production from the properties, production rates, ultimate reserve recovery, timing and amount of capital expenditures, marketability of oil and natural gas, royalty rates, the assumed effects of regulation by governmental agencies and future operating costs, all of which may vary materially. For these reasons, estimates of the economically recoverable crude oil, NGL and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at different times, may vary. Pieridae’s and the Assets’ actual production, revenues, taxes and development and operating expenditures with respect to their respective reserves will vary from estimates thereof and such variations could be material.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements and forward-looking information. In particular, this press release contains forward-looking statements and information concerning the anticipated completion of the proposed Acquisition, Offering and Term Debt Financing and the anticipated timing for completion thereof. In addition, this press release contains forward-looking statements and information regarding the production levels of the Assets; the quantity of Pieridae’s and the Assets’ oil and natural gas reserves and anticipated future cash flows from such reserves; anticipated benefits of the Acquisition to Pieridae, including the sufficiency of and ability from the cash flow derived from the Assets to significantly progress the Goldboro project towards a final investment decision; expected future net revenue from the Assets; the expectation that the Assets will provide greater cash flow stability; the decline rates of the Assets; the estimated NOI of the Assets; the value of synergy cost savings; and the ability of Pieridae to effectively integrate the Assets with its current operations. Although Pieridae believes that the expectations reflected in such forward-looking statements are reasonable, undue reliance should not be placed on forward-looking statements because Pieridae can give no assurance that such expectations will prove to be correct. Pieridae has made these forward looking statements and, in connection with the Acquisition, Offering and Term Debt Financing, provided these anticipated timelines, in reliance on certain assumptions and factors that Pieridae believes are reasonable at this time, including assumptions as to the ability of the parties to satisfy all conditions precedent to the completion of the Acquisition and the Term Debt Financing, the timing of receipt of the necessary regulatory approvals, the time necessary to satisfy the conditions to the closing of the Acquisition, the time necessary to raise the funds required under the Offering and the time required to negotiate and finalize definitive documentation for the Term Debt Financing. These assumptions may prove to be incorrect and these statements regarding the dates for completion may change for a number of reasons, including the inability to secure necessary regulatory approvals in the time assumed or the need for additional time to satisfy the conditions to the completion of the Acquisition, the Offering or the Term Debt Financing. Accordingly, there is no certainty that the Acquisition, the Offering or the Term Debt Financing will be completed in the timeframes set forth in this press release, or that they will be completed at all. Pieridae has also made assumptions regarding the general stability of the economic and political environment in which Pieridae operates; the ability of Pieridae to retain qualified staff, equipment and services in a timely and cost efficient manner; the ability of Pieridae to operate the Assets in a safe, efficient and effective manner; the timing and costs of pipeline, storage and facility construction and expansion and the ability of Pieridae to secure adequate product transportation; future oil and natural gas prices; currency, exchange and interest rates; the regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which Pieridae operates; timing and amount of capital expenditures, future sources of funding, production levels, weather conditions, success of exploration and development activities, access to gathering, processing and pipeline systems, advancing technologies, and the ability of Pieridae to successfully market its oil and natural gas. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Pieridae disclaims any intention and has no obligation or responsibility, except as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Barrels of oil equivalent (“boes”) may be misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf: 1 Bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

This press release contains future-oriented financial information and financial outlook information (collectively, "FOFI") about Pieridae’s prospective results of operations, cash flows, and components thereof, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set forth in the above paragraphs. FOFI contained herein is made as of the date of this press release and is provided for the purpose of describing the anticipated effects of the Acquisition, Offering and Term Debt Financing. Pieridae disclaims any intention or obligation to update or revise any FOFI contained in this document, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the FOFI contained in this document should not be used for purposes other than for which it is disclosed herein.

For further information please contact:

Alfred Sorensen, Chief Executive Officer

Telephone: (403) 261-5900

Melanie Litoski, Chief Financial Officer

Telephone: (403) 261-5900

James Millar, Director, External Relations

Telephone: (403) 261-5900

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] NOI is a non-IFRS measure. See the Company’s MD&A for the three months ended March 31, 2019 for a definition.

[2] See Pieridae press release dated December 20, 2018.

[3] See Pieridae press releases dated August 17, 2015 and November 21, 2018.

[4] See Pieridae press release dated October 29, 2018.

[5] See Pieridae press release dated February 4, 2019.

[6] See Pieridae press release dated May 5, 2017.