Who We Are

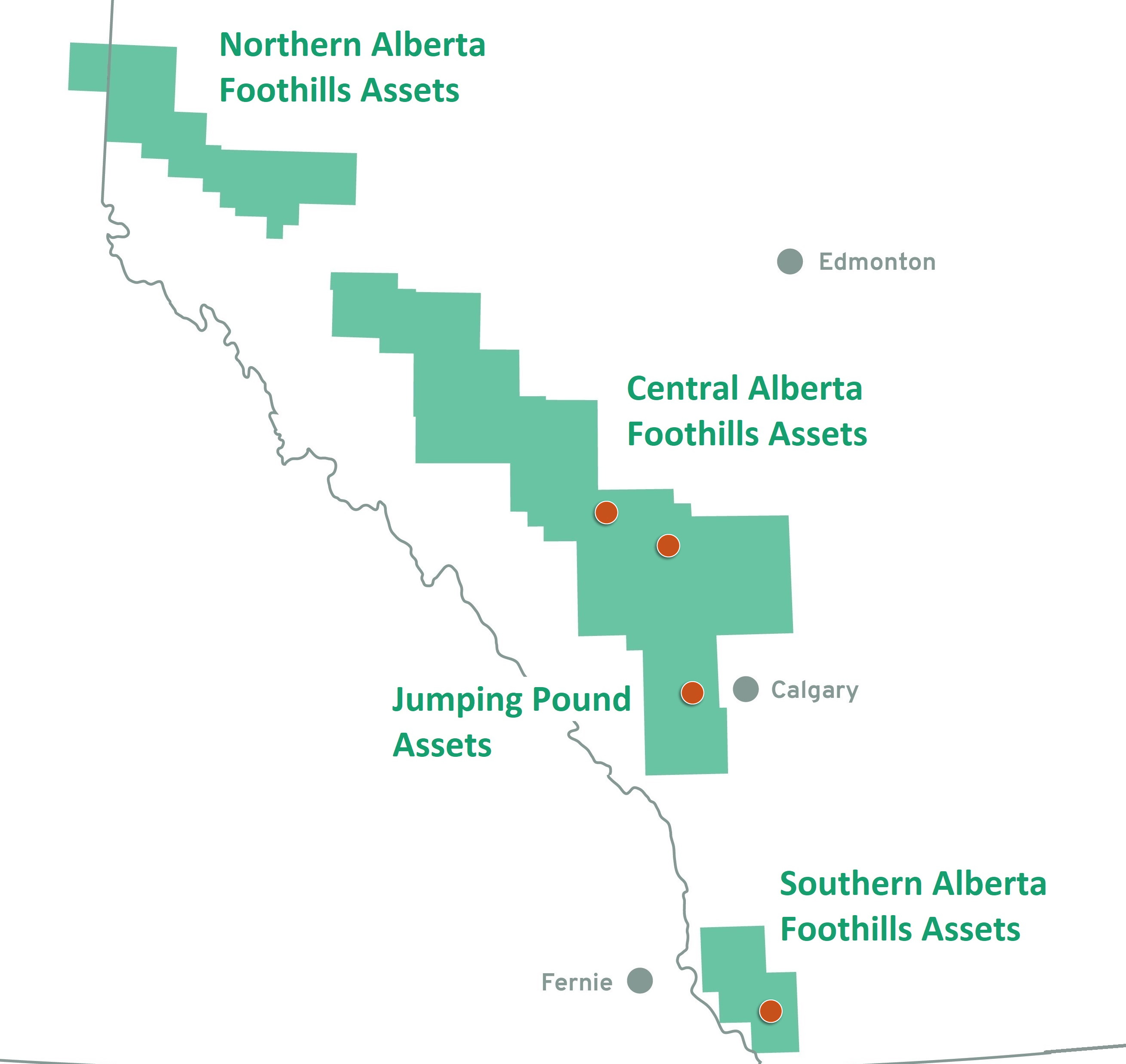

Established in 2012, Pieridae is a public E&P company with upstream and midstream assets concentrated in the Canadian Foothills, home to some of the largest conventional gas reservoirs in North America.

We are the largest Canadian Foothills producer, with production of nearly 40,000 boe/d (~80% natural gas, ~20% liquids) Gas, NGL, Condensate and Sulphur revenue streams.

Image

Pieridae Operations

29,509 BOE/D 2024 YTD

1,437 MT/D SULPHUR 2024 YTD

5.4% BASE DECLINE RATE

209 MMBOE PROVED RESERVES

3 DEEP CUT SOUR GAS PLANTS

$15.3 MM 3RD PARTY REV 2024 YTD

UNDEV. ACRES: 398K net

TAX POOLS $602 MM at Dec 31, 2023

Market Snapshot & Guidance

Assets Map

SELECTED QUARTERLY OPERATIONAL & FINANCIAL RESULTS