Pieridae Delivers Strong Q4 and 2019 Results

Revenue, Net Operating Income & Production All Up Substantially

Key Highlights:

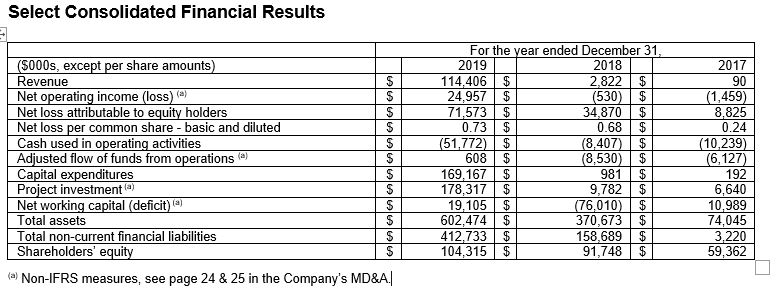

- Total revenue of $114.4 million in 2019. Petroleum and natural gas revenue increased $102.5 million year over year, or 4347%, to $104.9 million in 2019

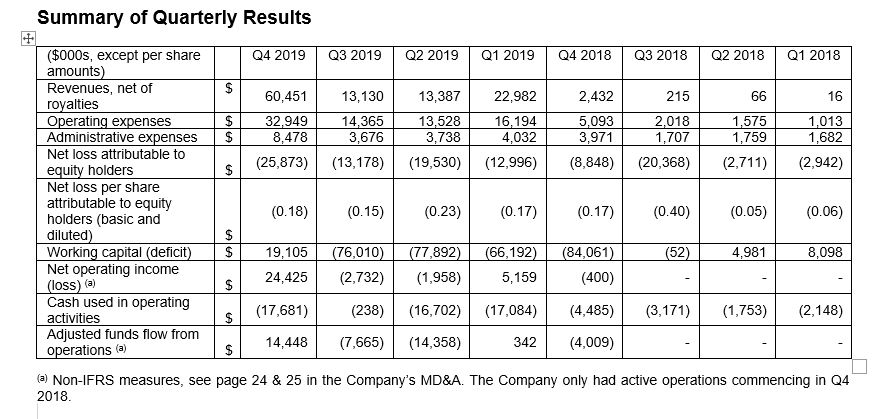

- Net Operating Income[1] (“NOI”) increased year over year from a loss of $0.5 million in 2018 to income of $24.9 million in 2019, $24.4 million of which was earned in Q4 2019

- Adjusted Funds Flow From Operations1 (“AFFO”) increased from a loss of $4.0 million in Q4 2018 to income of $14.4 million in Q4 2019

- Production increased 241% from 17,509 barrels of oil equivalent per day (“boe/d”) in Q4 2018 to 42,137 boe/d in Q4 2019

- A dramatic year over year improvement in working capital, from a deficit of $76.0 million in 2018 to a surplus of $19.1 million in 2019

- Proven Developed Producing (“PDP”) reserve bookings increased by 158% due to the Shell Foothills assets acquisition

- Total Proved plus Probable (“TPP”) bookings increased by 123%, while the corporation maintained a very conservative booking of 62% PDP reserves out of total proved plus probable reserves

- PDP value more than doubled to $593 million, versus $245 million

- Corporate 2020 forecasted decline in the PDP reserve category is approximately 9%, annually, which is remarkably low amongst our peer group of companies

[1] NOI and AFFO are non-IFRS measures. They do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. See page 24 and 25 in the Company’s MD&A.

CALGARY, ALBERTA – April 16, 2020 - Pieridae Energy Limited (“Pieridae” or the “Company”) (PEA - TSXV) released its 2019 financial and operating results today, highlighted by the fact the Company recorded strong year-over-year increases in multiple categories, including petroleum and natural gas revenue (a 4347% increase to $104.9 million, included in the total 2019 company revenue of $114.4 million), NOI (a loss of $0.5 million to income of $24.9 million), AFFO (a loss of $4.0 million in Q4 2018 to income of $14.4 million in Q4 2019) and production (a 241% increase from 17,509 boe/d in Q4 2018 to 42,137 boe/d in Q4 2019). In addition, Pieridae advanced its flagship Goldboro LNG Project and made adjustments to its business to deal with the impacts of COVID-19.

“Q4 2019 proved to be a transformational quarter in Pieridae’s history as we closed the acquisition of extensive Alberta Foothills natural gas assets last fall. The immediate impact of growing production, increased sales of natural gas liquids and the growth in third-party processing thanks to our midstream assets are fully evident in our financial results,” said Pieridae’s Chief Executive Officer Alfred Sorensen. “We have delivered on our commitments to shareholders by maximizing the value of our assets and continuing to focus on reducing operating costs, preserving cash, protecting our balance sheet and being ready to move forward as the industry improves.

“Work continues on multiple fronts with our Goldboro LNG Facility, primarily with KBR to finalize a fixed price contract to design and build the facility. Market conditions and the global fallout from COVID-19 have impacted our ability to make a final investment decision this fall but we are confident it will happen once conditions improve and we can better analyze the landscape,” concluded Sorensen.

Financial and operational information is set out below and should be read in conjunction with Pieridae’s December 31, 2019 Annual Report which includes the Corporation’s audited annual financial statements and the related management's discussion and analysis ("MD&A"). In addition, the Corporation today announces the filing of its Annual Information Form ("AIF") for the year ended December 31, 2019 that contains the Corporation's reserves and other oil and natural gas information, as required under National Instrument 51-101 Standards of Disclosure of Oil and Gas Activities. The AIF, Annual Report, audited financial statements and MD&A are available for review at www.sedar.com and on the Corporation's website.

Financial Performance:

We saw pronounced growth in NOI year over year, from a loss of $0.5 million in 2018 to income of $24.9 million 2019, $24.4 million of which was earned in Q4 2019. This was due to the increased production in Q4, including growth in natural gas liquids (“NGLs”) and condensate, afforded by the deep-cut capability of the processing facilities acquired from Shell, which allowed Pieridae to realize new revenue streams which include ethane, propane, butane, sulphur and condensate, and also significant midstream revenue.

Total revenue for 2019 was $114.4 million. Breaking that down, petroleum and natural gas revenue increased $102.5 million, or 4347% to $104.9 million during the year ended December 31, 2019 as compared to the year ended December 31, 2018. This increase was largely attributable to the year over year increase in sales volumes, as the average price per boe only increased by 2.4%, as a result of a more favourable product mix and successful hedge program. This large year-over-year increase in sales volumes is directly attributable to the two transformational transactions Pieridae completed in 2018 and 2019.

For 2019, natural gas and NGLs revenues include the results of Pieridae’s commodity hedging programs, which are primarily physical hedges. Pieridae seeks to manage price risk across all the commodities it produces including, natural gas, oil, condensate, propane, butane, ethane, sulphur and currency. The hedging programs focuses on two primary goals: first reducing overall commodity revenue volatility and secondly achieving or protecting revenue targets for overall corporate. Favorable pricing for these hedges helped to put a more sustainable floor under prices. The Company realized a natural gas price of $1.75/mcf in 2019 vs $1.57/mcf in 2018. The improvement versus 2018 was attributable to a successful hedge program and strengthening of natural gas prices in late Q3 2019.

Other revenue, consisting of gas handling and transportation fees, and third-party processing revenue increased $9.1 million, or 2,222% to $9.5 million during the year ended December 31, 2019 as compared to the year ended December 31, 2018. This increase primarily reflects 10 weeks of results from our deep-cut processing facilities and associated infrastructure in late 2019, and Pieridae’s midstream revenue diversification.

Pieridae has dramatically improved its working capital (“WC”) from a deficit of $76.0 million in 2018 to a surplus of $19.1 million 2019. This dramatic improvement in WC is primarily due to repayment of the $50 million term debt which was classified as a current liability at December 31, 2018, and the acquisition of $23.5 million of inventory as part of the Shell Foothills assets acquisition, as well as the accretive cash flows generated by the assets acquired from Shell.

In 2019, as a result of the acquisition mentioned above, the Company re-evaluated its licenses in Québec, which are recorded as exploration and evaluation (“E&E”) assets. Pieridae concluded these properties no longer met its internal investment thresholds for future development. Consequently, the remaining carrying value of these properties was written off resulting in a $19.7 million impairment charge. This write off, combined with a previous $7.9 million charge, brought the total impairment for 2019 to $27.6 million. All remaining E&E assets are associated with exploration work ongoing in western Canada.

Operations Performance:

Production for the three months ended December 31, 2019 increased 241% up to an average of 42,137 boe/d compared to 17,509 boe/d for the same quarter of 2018. Natural gas was the largest component at 34,044 boe/d, representing approximately 81% of total production. NGL’s were 5,190 bbl/day (12%) and condensate was 2,923 bbl/day (7%). For the year ended December 31, 2019, average production increased 28% to 22,397 boe/d in 2019 from 17,509 boe/d for the same period of 2018.

Realized natural gas prices were $1.91/mcf in Q4 2019 versus $1.57/mcf in Q4 2018. Overall petroleum and natural gas revenues per boe increased from $12.52/boe in Q4 2018 to $14.60/boe in Q4 2019. The growth in overall production together with cost savings initiatives caused operating costs/boe to decrease from $13.64/boe in Q4 2018 to $8.50/boe in Q4 2019. Transportation expenses also benefitted from the growth in production and decreased from $1.07/boe in Q4 2018 to $0.79/boe in Q4 2019. Overall netback per boe increased from a loss of $2.08/boe in Q4 2018 to a profit of $6.20/boe in Q4 2019.

The Company has a hedging program in place to insulate itself from deteriorating prices, resulting in approximately 60% of our boes being hedged as at December 31, 2019. This program has proven successful at providing a degree of pricing certainty and revenue stability during these volatile times.

The acquired Foothills assets produce approximately 29,000 boe/d consisting of approximately 125 mcf/day of natural gas, 5,400 bbl/day of NGLs and 3,100 bbl/day of condensate and light oil. The acquired three deep cut sour gas processing plants (Jumping Pound, Caroline and Waterton) have a combined capacity of approximately 750 mmcf/day and operate with approximately 420 mmcf/day of spare capacity as at December 31, 2019. On a combined basis, Pieridae averaged 42,137 boe/day in the quarter ended December 31, 2019.

Our Board and senior leadership have incorporated environmental, social and governance (“ESG”) performance as a key goal for 2020. Pieridae will build on an established, strong ESG framework that allows us to continue to develop, monitor and manage our assets, and measure performance. From a health, safety and environment (“HS&E”) perspective, Pieridae had a very successful year in 2019 with high ratings on all of its HS&E programs, and no major incidents. That's a major success for the Company.

Goldboro LNG:

The Goldboro LNG facility has progressed to the open book estimate stage (“OBE”) and Kellogg, Brown and Root Limited (“KBR”) has been engaged to review the previously completed front end engineering and design (“FEED”) study and provide a fixed price contract to construct the gas liquefaction facility. Pieridae has sole responsibility to contract companies to prepare the site, build the wharf and jetty and construct the work camp. These projects will be financed concurrently with a positive final investment decision (“FID”), with project construction to follow.

Under the FEED study, Air Products and Chemicals, Inc. will develop, design and deliver a two-train (each train producing 4.8 million metric tons per annum of LNG) facility. It is expected to take 56 months to build a two-train project. Much of the construction should involve assembling modules built in offshore yards while employing approximately 4,500 local workers during peak construction. These employees will be housed at a temporary camp, which will be built on or nearby the existing decommissioned Sable Island sour gas plant site. Site preparation, site drainage, highway reconstruction and marine facilities are some of the major projects that must be assembled in tandem with, or prior to, the LNG liquefaction facility construction.

Following the FEED verification, KBR will proceed to the OBE stage where they will begin contacting numerous contractors in order to set a fixed price to build Goldboro LNG and ensure it is operational. The fixed price and terms and conditions of the EPC contract will be negotiated following the agreement of detailed scope and timeline.

As a result of a depressed market and COVID-19 impacts, FID for the Project will be delayed beyond September 30, 2020. A further announcement will be made once COVID-19 conditions improve and markets stabilize.

COVID-19 Response/Adjustments:

As the world grapples with this pandemic, Pieridae reacted quickly and decisively in dealing with its potential impacts on our business. First and foremost, the safety and the physical and mental health of our employees are our top priorities, along with ensuring our assets continue to operate safely and efficiently, which they have. As well, our hedging program materially sheltered us from a significant revenue drop.

An internal management committee has been meeting daily to ensure Pieridae is following all of the protocols set out by the Public Health Agency of Canada and Alberta Health. Business travel and group gatherings have been cancelled, all non-essential employees are working from home, a focus on social distancing and proper hand-washing is stressed daily, and anyone exhibiting COVID-19 symptoms will self-isolate for 14 days.

Pieridae is undertaking a review of its cost structure in response to the current environment.

2019 Developments:

Mi’kmaq Benefits Agreement Signed

On February 4, 2019 Pieridae signed a benefits agreement with the Assembly of Nova Scotia Mi’kmaq Chiefs. The agreement means the Mi’kmaq will benefit economically as the Goldboro LNG facility is developed, built and begins operations.

KBR Engagement

On April 1, 2019, the Company announced that it had engaged KBR to perform a review of an amended version of the previously prepared FEED study for its proposed Goldboro LNG Facility. KBR will also conduct an open book estimate necessary for entering into a lumpsum engineering, procurement and construction contract. The proposed activities are expected to occur over the next number of months.

Shell Foothills Assets Acquisition

On June 26, 2019, Pieridae took a major step forward in acquiring the natural gas needed to supply the first train (or facility) at the proposed Goldboro LNG export facility with the signing of a $190 million purchase and sale agreement with Shell Canada Energy to acquire all of Shell’s midstream and upstream assets in the southern Alberta Foothills. The agreement included approximately 29,000 boe/d; three deep cut sour gas processing plants: Jumping Pound, Caroline and Waterton; a 14% working interest in the Shantz sulphur forming plant; and approximately 1,700 kilometers of pipelines.

On October 16, 2019, Pieridae announced it had completed this transformational milestone for the Company by closing the transaction.

Pieridae now has a footprint stretching from northeast B.C. along the Alberta Foothills down to the U.S border, nearly one million net acres of land and 3,500 kilometers of pipelines. Production for Q4 2019 was 42,137 boe/d:

- 204 mmcf/d of natural gas (34,044 boe/d)

- 5,190 bbl/d of natural gas liquids

- 2,923 bbl/d of condensate

The Company also gained an extensive drilling inventory including multiple dry gas and liquids-rich gas reservoirs in the Foothills, and is now in an ideal position to leverage the US$1.5 billion of anticipated German Government-backed loan guarantees for conventional gas supply development. The process of the transfer of licenses from Shell to Pieridae continues. We expect an update from the Alberta Energy Regulator near the end of April, 2020.

Uniper Deadlines Extensions

On July 9, 2019, negotiated extensions of the key deadlines were completed under Pieridae’s 20-year agreement with Germany’s largest utility Uniper. These included expected commercial deliveries of gas to Uniper to start between November 30th, 2024 and May 31st, 2025; and the extension to September 30, 2020 of the deadline to make a positive FID for the Company’s proposed Goldboro LNG facility. Pieridae is currently in negotiations with Uniper to extend the FID deadline to June 2021 and believes it will obtain this extension. The 20-year agreement with Uniper is for all of Train 1 at Goldboro or 5 million tonnes per annum.

In 2020, crude oil prices decreased substantially due to a drop in global oil demand triggered by the impact of the COVID-19 virus on the world’s economy. In March 2020, oil prices dropped even further following a price war between Saudi Arabia and Russia after negotiations broke down over production cuts. As stated earlier, as a result of a depressed market and COVID-19 impacts, FID will be delayed beyond September 30, 2020. A further announcement will be made once COVID-19 impacts and markets stabilize.

Pieridae Names New Chief Financial Officer (“CFO”)

On November 11, 2019, Pieridae bolstered its leadership capacity with the appointment of Rob Dargewitcz as CFO. Rob and his team, together with assistance from operational leaders, did a stellar job in helping to secure the financing needed to close the transformational Shell Foothills assets acquisition. After helping to raise $10 billion to construct the North West Redwater refinery in Alberta, his skill set is well positioned to bring in the larger financing needed to build Goldboro LNG.

Reserves:

Highlights

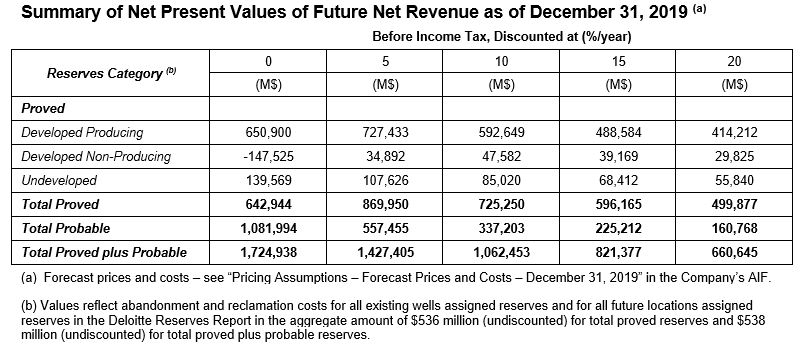

Pieridae’ reserves have increased significantly over 2018 due the acquisition of significant volumes of long-life reserves in the southern Alberta Foothills. Overall, the PDP base decline of the corporation is now at ~ 9% (based on 2020, PDP forecasts), which is one of the lowest in industry. This decline will provide a very reliable base production from which the corporation will grow significantly in the next few years to supply the Goldboro LNG Facility in eastern Canada.

PDP gas reserves have increased 399.0 Bcf (95.1 MMBoe) over last year, including yearly production depletion and early economic termination of some wells, due to lower forecast commodity prices, as compared to 2018.

Total PDP reserves are 62% of the total reserves, and proven developed reserves are 69% of total, which, amongst our peer companies, would be considered conservative. Our Proved Undeveloped (“PUD”) category represent only 6% of the total reserves’ category (10.3 MBoe out of 183.6 MBoe), which could also be considered to be very conservative amongst our peers.

Pieridae’s 2P, total proved ("TP"), and PDP reserves all increased relative to 2018. The reserve acquisition late in 2018 was very complimentary to our reserve base, since we were able to consolidate working interests and eliminate superfluous costs in the field, that result from scattered working interests and lack of ownership in certain midstream facilities. We saw PDP value more than double year-over-year to $593 million, versus $245 million, despite a 10%-20% decrease of forecast commodity prices.

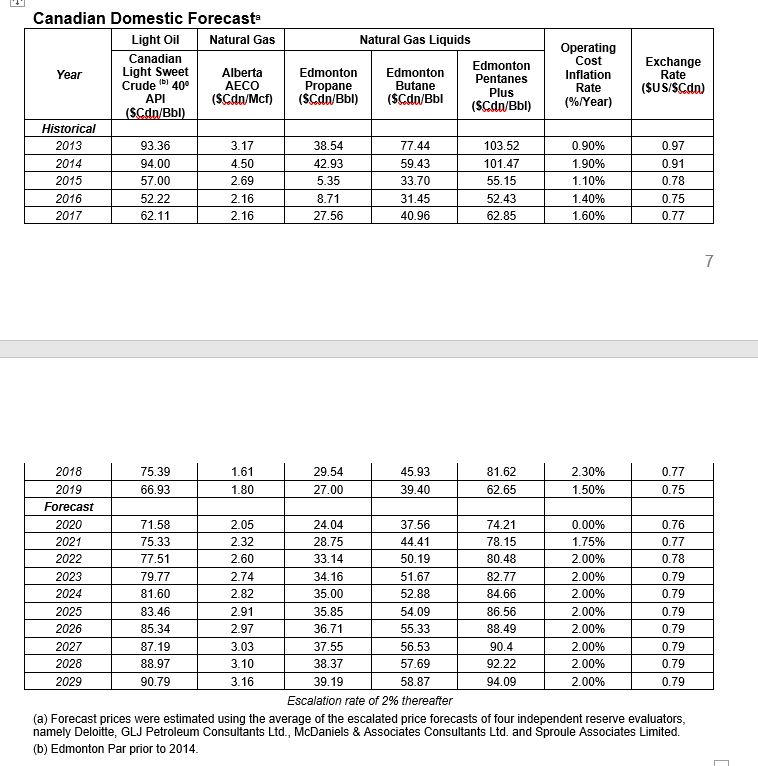

2019 Independent Reserves Evaluation

Deloitte conducted an independent Reserves Evaluation effective December 31, 2019, which was prepared in accordance with definitions, standards and procedures contained in the Canadian Oil and Gas Evaluation Handbook and NI 51-101. The Reserves Evaluation was based on “IC4” average price from four Independent Consultant Evaluators, including Deloitte, McDaniel, Sproule, and GLJ and foreign exchange rates at January 1, 2020 as outlined in this release.

Stated reserves are company gross basis (working interest before deduction of royalties without

the inclusion of any royalty interest) unless otherwise noted. In addition to the information disclosed in this news release, more detailed information will be included in the corporation’s AIF for the year ended December 31, 2019.

Reserve Life Index ("RLI")

Pieridae’s 2P RLI was 14.7 years in 2019, which is contingent upon the execution of a $125.6 million capital program. The modest capital costs relate to the high proportion of PDP booking compared to total reserves.

Net Present Value Summary

Pieridae’s crude oil, natural gas and NGLs reserves were evaluated using the IC4 forecast pricing and foreign exchange rates at January 1, 2020, as described above. The NPV value is prior to the provision for interest, debt service charges, and G&A expense. It should not be assumed that the NPV of future net revenue estimated by Deloitte represents the fair market value of Pieridae’s reserves.

2020 Guidance:

We now anticipate NOI in the range of $70 million - $90 million, production of 40,000 - 45,000 boe/d, a $28 million capital spend, a $16 million Goldboro LNG development expense spend, commodities hedging of 55-65% on a boe/d basis, and $11.50-$13.00/boe operating costs[1].

[1] Does not include transportation costs of ~$0.90/boe

Board Change:

Adding intellectual capital and leadership continues to be a priority, so we were pleased last fall to announce the appointment of Mark Horrox as an additional independent director. Mark is a principal at Third Eye Capital, with 20 years of global experience investing in companies undergoing change or growth.

About Pieridae:

Founded in 2011, Pieridae, a majority Canadian owned corporation based in Calgary, is focused on the development of integrated energy-related activities, from the exploration and extraction of natural gas to the development, construction and operation of the Goldboro LNG facility and the production of LNG for sale to Europe and other markets. Pieridae is on the leading edge of the re-integration of the LNG value chain in North America. After completion of all the transactions disclosed in this news release, Pieridae has 157,641,871 common shares issued and outstanding which trade on the TSX Venture Exchange (“PEA”).

For further information please contact:

Alfred Sorensen, Chief Executive Officer

Telephone: (403) 261-5900

Rob Dargewitcz, Chief Financial Officer

Telephone: (403) 261-5900

James Millar, Director, External Relations

Telephone: (403) 261-5900

Forward-Looking Statements

statements contained herein may constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws (collectively "forward-looking statements"). Words such as "may", "will", "should", "could", "anticipate", "believe", "expect", "intend", "plan", "potential", "continue", "shall", "estimate", "expect", "propose", "might", "project", "predict", "forecast" and similar expressions may be used to identify these forward-looking statements.

Forward-looking statements involve significant risk and uncertainties. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements including, but not limited to, risks associated with oil and gas exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of resources estimates, environmental risks, competition from other producers, incorrect assessment of the value of acquisitions, failure to realize the anticipated benefits or synergies from acquisitions, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources and the risk factors outlined under "Risk Factors" and elsewhere herein. The recovery and resources estimate of Pieridae's reserves provided herein are estimates only and there is no guarantee that the estimated resources will be recovered. As a consequence, actual results may differ materially from those anticipated in the forward-looking statements.

Forward-looking statements are based on a number of factors and assumptions which have been used to develop such forward-looking statements, but which may prove to be incorrect. Although Pieridae believes that the expectations reflected in such forward-looking statements are reasonable, undue reliance should not be placed on forward-looking statements because Pieridae can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified in this document, assumptions have been made regarding, among other things: the impact of increasing competition; the general stability of the economic and political environment in which Pieridae operates; the timely receipt of any required regulatory approvals; the ability of Pieridae to obtain qualified staff, equipment and services in a timely and cost efficient manner; the ability of the operator of the projects which Pieridae has an interest in, to operate the field in a safe, efficient and effective manner; the ability of Pieridae to obtain financing on acceptable terms; the ability to replace and expand oil and natural gas resources through acquisition, development and exploration; the timing and costs of pipeline, storage and facility construction and expansion and the ability of Pieridae to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; the regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which Pieridae operates; timing and amount of capital expenditures, future sources of funding, production levels, weather conditions, success of exploration and development activities, access to gathering, processing and pipeline systems, advancing technologies, and the ability of Pieridae to successfully market its oil and natural gas products.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on these and other factors that could affect Pieridae's operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com), and at Pieridae's website (www.pieridaeenergy.com). Although the forward-looking statements contained herein are based upon what management believes to be reasonable assumptions, management cannot assure that actual results will be consistent with these forward-looking statements. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and Pieridae assumes no obligation to update or review them to reflect new events or circumstances except as required by Applicable Securities Laws.

Forward-looking statements contained herein concerning the oil and gas industry and Pieridae's general expectations concerning this industry are based on estimates prepared by management using data from publicly available industry sources as well as from reserve reports, market research and industry analysis and on assumptions based on data and knowledge of this industry which Pieridae believes to be reasonable. However, this data is inherently imprecise, although generally indicative of relative market positions, market shares and performance characteristics. While Pieridae is not aware of any misstatements regarding any industry data presented herein, the industry involves risks and uncertainties and is subject to change based on various factors.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.