Pieridae Announces First Quarter Results

Solid Financial Returns for a Second Straight Quarter

Highlights:

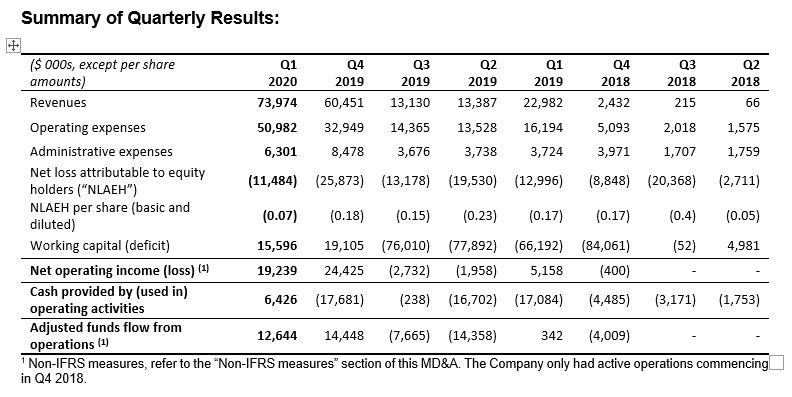

- Revenue of $74.0 million in Q1 2020, an increase of $51.0 million or 222% compared to Q1 2019

- Petroleum and natural gas revenue increased by $41.4 million or 178% compared to Q1 2019

- Net operating income[1] (“NOI”) increased by $14.1 million or 273% compared to Q1 2019

- Adjusted Funds Flow From Operations1 (“AFFO”) increased by $12.0 million or 1,845% compared to Q1 2019, and cashflow from operations improved from a deficit of $17.1 million to $6.4 million

- Q1 2020 average production was 41,211 barrels of oil equivalent per day (“boe/day”), an increase of 23,975 boe/day or 139% compared to Q1 2019

- Natural gas physical hedging resulted in a realized natural gas price of $2.23/mcf, 15% higher than benchmark prices of $1.94/mcf for the quarter

CALGARY, ALBERTA – May 28, 2020 - Pieridae Energy Limited (“Pieridae” or the “Company”) (PEA - TSXV) released its Q1 2020 results today, highlighted by the fact the Company recorded a second straight quarter with strong metrics in revenue, NOI, AFFO and daily production. Pieridae's unaudited condensed interim financial statements and MD&A are available on our website at www.pieridaeenergy.com and are filed on SEDAR at www.sedar.com.

“We continue to see the benefits of last fall’s Foothills Asset acquisition, with Pieridae recording strong financial results in spite of very challenging market conditions,” said Pieridae’s Chief Executive Officer Alfred Sorensen. “Once again, our strong operational performance and positive hedging strategy helped insulate us from the current harsh realities, as realized natural gas prices were 15% higher than the benchmark price for the quarter.”

With a severe drop in oil prices and the overall impacts of COVID-19, some companies have had to deal with impairment charges as well as sizeable reductions in capital spending. Pieridae has not been required to take similar impairments in the quarter, and capital spending as well as the development budget for the Goldboro LNG Project remain intact.

“With a number of global LNG projects either being cancelled or delayed, now is the time for Canada to seize the opportunity to enter into this industry at a time when others are exiting. Our Goldboro LNG Project is sound and supports the fundamental principles of First Nations reconciliation; interlocks with the goals of the Paris Climate Accord; would create good paying, middle-class jobs across the country; and opens up new energy trade routes to get sustainably-produced Canadian natural gas to global markets,” concluded Sorensen.

Q1 2020 Financial & Operations Highlights

Revenue of $74.0 million in Q1 2020 increased by $51.0 million or 222% compared to Q1 2019. This was due to three full months of operations from the combined natural gas and midstream assets purchased in 2018 and 2019. Third party processing fees together with expanded NGL and condensate production also contributed to the increase. Q1 2020 petroleum and natural gas revenue increased by $41.4 million or 178% compared to Q1 2019, including additional revenues as well as new revenue streams brought on as a result of the capabilities of the new assets acquired in the Foothills Asset acquisition.

NOI increased by $14.1 million or 273% compared to Q1 2019 due to the accretive production and revenue mix from the acquisition of the Foothills Assets last fall. Similarly, AFFO increased by $12.0 million or 1,845%, and cashflow from operations improved from a deficit of $17.1 million to $6.4 million during the quarter, providing further financial flexibility and improving working capital.

Operating netback in Q1 2020 increased by $1.82/boe or 55% as compared to Q1 2019. This was the result of a combination of higher average realized pricing and more diversified revenue streams.

This continuation of the transformational growth recorded in Q4 2019 will provide Pieridae with the liquidity it needs to operate its assets, as well as further de-risk the development work required for the multi-billion dollar Goldboro LNG Project.

[1] NOI and AFFO are non-IFRS measures. They do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. See pages 18 and 19 in the Company’s MD&A.

As previously highlighted, Q1 2020 production was 41,211 boe/day, an increase of 23,975 boe/day or 139% compared to the Q1 2019. This increase is primarily due to the Foothills Asset acquisition, partially offset by unplanned outages in the first two months of 2020 at two gas processing facilities during the coldest weeks of the year, which was rectified during the quarter. The significant growth in condensate and NGL production in the quarter reflects the deep cut capacity of the processing facilities acquired last fall.

The Company continues to have a strong hedging program in place to partially insulate itself from volatile commodity prices, which has proven successful at providing a degree of pricing certainty and revenue stability during these uncertain and challenging times. Realized natural gas prices were $2.23/mcf, which is $0.29/mcf or 15% higher than benchmark prices of $1.94 during the quarter.

COVID-19 Response/Adjustments:

The Company reacted quickly and decisively early on in dealing with the potential impacts of COVID-19, implementing strict and consistent guidelines such as respecting the requirement for social distancing; a focus on frequent hand-washing; and having the protocol at the ready to self-isolate should anyone exhibit symptoms of the virus, which no employee has experienced.

Since mid-March, a majority of Pieridae head office employees have been working remotely, with the aligned purpose of ensuring all of the Company’s assets continue to operate safely and reliably. The assets have continued to perform well, without incident.

Pieridae maintained its focus on protecting the physical and mental well-being of its employees while doing all it could to protect against layoffs of full-time staff. That said, the Company has recognized the need to react to ensure the business remains viable for the near and long-term. The Board and CEO have absorbed a 20% reduction in compensation, VPs and above received a 15% cut and there has been a reduction of 10% in earnings for all salary/hourly employees.

AER Shell Asset Licence Transfer Decision:

On May 13, 2020, the Alberta Energy Regulator (“AER”) made the decision to deny the application to transfer licences from Shell’s Foothills Assets to Pieridae.

While disappointed by the AER’s decision, both Pieridae and Shell are moving swiftly to evaluate options on the transfer applications and will continue to attempt to seek clarity from the regulator to define an appropriate path forward.

The decision has nothing to do with Pieridae’s financial position nor its ability to remediate certain assets. The issue for denial was the fact that there is no precedent for splitting a licence or no ability under the current legislation to do so, which is how the application submitted by Shell was presented to the AER. This issue only applies to the Waterton and Jumping Pound gas plants.

The Foothills Assets are high quality and they include operating wells and three deep-cut sour gas processing plants with long term potential and remain attractive as the anchor production for our Goldboro LNG Project.

The Company is confident that the Shell Asset acquisition, having previously closed and been successfully integrated into Pieridae's operations, can be aligned to address the concerns of the AER. Pieridae continues to maintain a solid relationship with Shell Canada and they remain with us as we work through a solution to this matter.

Q1 2020 Developments:

Uniper Deadlines Extensions

On May 5, the Company announced that it and energy company Uniper Global Commodities agreed to extend key deadlines under their joint, 20-year agreement. The deadline extensions included expected commercial deliveries of gas to Uniper to start between August 31, 2025 and February 28, 2026; and the extension to June 30, 2021 of the deadline to make a positive final investment decision for the Company’s proposed Goldboro LNG Facility. The 20-year agreement with Uniper is for all of the liquefied natural gas produced at Goldboro Train 1 or 4.8 million tonnes per annum (“mmtpa”).

Pieridae remains focused on progressing work with KBR to deliver a fixed price contract to build the gas liquefaction Facility. The Company has begun to contract for services outside the primary engineering, procurement, construction and commissioning contract with the intent to begin the site preparation work as soon as possible. Some of these main activities include building the wharf and jetty, road reconstruction and constructing the work camp.

Guidance:

We anticipate 2020 NOI in the range of $70 million to $90 million, production of 40,000 to 45,000 boe/day, capital expenditures of $28 million, and investment in Goldboro LNG development expense of $16 million. We anticipate commodities hedging of 40% to 60% on a boe/day basis, and $11.50 to $13.00/boe realized operating costs, not including transportation costs of approximately $0.90/boe.

About Pieridae

Founded in 2011, Pieridae, a majority Canadian owned corporation based in Calgary, is focused on the development of integrated energy-related activities, from the exploration and extraction of natural gas to the development, construction and operation of the Goldboro LNG facility and the production of LNG for sale to Europe and other markets. Pieridae is on the leading edge of the re-integration of the LNG value chain in North America. After completion of all the transactions disclosed in this news release, Pieridae has 157,641,871 common shares issued and outstanding which trade on the TSX Venture Exchange (“PEA”).

For further information please contact:

Alfred Sorensen, Chief Executive Officer

Telephone: (403) 261-5900

Rob Dargewitcz, Chief Financial Officer

Telephone: (403) 261-5900

James Millar, Director, External Relations

Telephone: (403) 261-5900

Forward-Looking Statements

statements contained herein may constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws (collectively "forward-looking statements"). Words such as "may", "will", "should", "could", "anticipate", "believe", "expect", "intend", "plan", "potential", "continue", "shall", "estimate", "expect", "propose", "might", "project", "predict", "forecast" and similar expressions may be used to identify these forward-looking statements.

Forward-looking statements involve significant risk and uncertainties. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements including, but not limited to, risks associated with oil and gas exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of resources estimates, environmental risks, competition from other producers, incorrect assessment of the value of acquisitions, failure to realize the anticipated benefits or synergies from acquisitions, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources and the risk factors outlined under "Risk Factors" and elsewhere herein. The recovery and resources estimate of Pieridae's reserves provided herein are estimates only and there is no guarantee that the estimated resources will be recovered. As a consequence, actual results may differ materially from those anticipated in the forward-looking statements.

Forward-looking statements are based on a number of factors and assumptions which have been used to develop such forward-looking statements, but which may prove to be incorrect. Although Pieridae believes that the expectations reflected in such forward-looking statements are reasonable, undue reliance should not be placed on forward-looking statements because Pieridae can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified in this document, assumptions have been made regarding, among other things: the impact of increasing competition; the general stability of the economic and political environment in which Pieridae operates; the timely receipt of any required regulatory approvals; the ability of Pieridae to obtain qualified staff, equipment and services in a timely and cost efficient manner; the ability of the operator of the projects which Pieridae has an interest in, to operate the field in a safe, efficient and effective manner; the ability of Pieridae to obtain financing on acceptable terms; the ability to replace and expand oil and natural gas resources through acquisition, development and exploration; the timing and costs of pipeline, storage and facility construction and expansion and the ability of Pieridae to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; the regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which Pieridae operates; timing and amount of capital expenditures, future sources of funding, production levels, weather conditions, success of exploration and development activities, access to gathering, processing and pipeline systems, advancing technologies, and the ability of Pieridae to successfully market its oil and natural gas products.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on these and other factors that could affect Pieridae's operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com), and at Pieridae's website (www.pieridaeenergy.com). Although the forward-looking statements contained herein are based upon what management believes to be reasonable assumptions, management cannot assure that actual results will be consistent with these forward-looking statements. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and Pieridae assumes no obligation to update or review them to reflect new events or circumstances except as required by Applicable Securities Laws.

Forward-looking statements contained herein concerning the oil and gas industry and Pieridae's general expectations concerning this industry are based on estimates prepared by management using data from publicly available industry sources as well as from reserve reports, market research and industry analysis and on assumptions based on data and knowledge of this industry which Pieridae believes to be reasonable. However, this data is inherently imprecise, although generally indicative of relative market positions, market shares and performance characteristics. While Pieridae is not aware of any misstatements regarding any industry data presented herein, the industry involves risks and uncertainties and is subject to change based on various factors.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.